Melbourne Stamp Duty Calculator – Buying a property is a long-term financial commitment, and the initial costs go beyond the purchase price.

One of the biggest upfront expenses is stamp duty. Understanding how much you’ll need to pay can make or break your budget, which is why using a stamp duty calculator is a smart step if you’re buying a home in Melbourne or elsewhere in Australia.

Here’s an explainer about what stamp duty is and how to use a calculator to figure out how much you will have to pay.

What is stamp duty?

Land transfer duty is a government tax charged on certain transactions, including property purchases. This is the formal name, but it has been referred to as stamp duty in the past and most people still use this term.

The exact amount of stamp duty you pay in Melbourne/Victoria depends on the property’s value and whether you qualify for a concession or exemption. It is a one-off cost, usually paid at settlement, and it usually adds tens of thousands of dollars to the total cost of buying a home or investment property.

Knowing how much land transfer duty/stamp tax will apply to your purchase early on will help you avoid surprises when it’s time to finalise the purchase.

What does a stamp duty calculator tell you?

A stamp duty calculator gives you an estimate of the land transfer duty you will owe by factoring in several important details. It is a straightforward online tool that will ask you to enter information such as:

- Location: The state or territory determines the applicable rates and concessions.

- Property value: The higher the purchase price, the higher the stamp duty in most cases.

- Property type: Whether it’s an established home, new home or vacant land.

- Property use: Whether you plan to live in the property or hold it as an investment.

- Purchasing status: Whether this is your first home or unit (you may qualify for an exemption).

Enter these details and the calculator will give you an estimated figure.

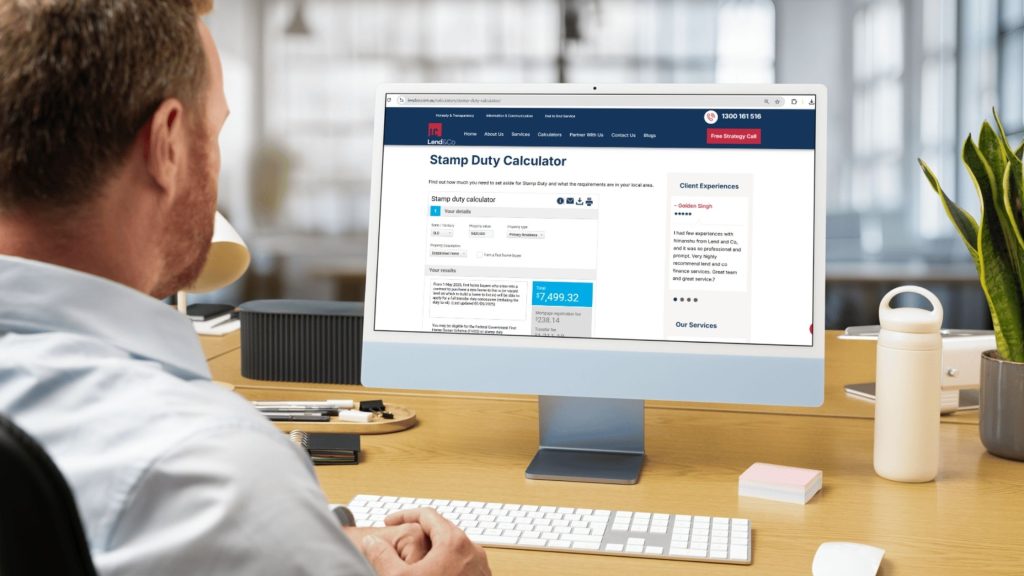

Want to get started? Lend & Co’s stamp duty calculator is designed for Australian buyers and makes it easy to test different scenarios before making a decision. You can also find helpful calculators to help you estimate loan repayments, borrowing power and more on our website.

Common stamp duty calculator mistakes to avoid

Stamp duty calculators are helpful, but the accuracy of the result depends on the information you provide.

Common mistakes include:

- Incorrect purchase price: Using a rough estimate instead of the actual contract price can produce misleading results.

- Forgetting the property’s purpose: Whether the property is an investment or a principal place of residence can change the calculation.

- Leaving out property type: Stamp duty differs for vacant land, new builds and established homes, so be sure to select the right option.

- Overlooking concessions or exemptions: First-home buyer benefits or state-based concessions may apply, but they need to be included in the calculator.

Finally, you shouldn’t have to pay to use a stamp duty calculator, or even enter any personal details to get the estimate you are looking for, so be wary of operators who want to charge you or won’t supply the answer without you entering your email address.

Buying a home? Don’t forget about stamp duty

For many buyers, stamp duty/land transfer duty can be the second-largest cost after your deposit. If you’re buying in Victoria, for example, a $700,000 property will attract around $38,000 in stamp duty, depending on your circumstances.

Factoring in stamp duty early gives you a clearer picture of how much money you will either need upfront, or the true amount you need to borrow for your home loan.

Get Local Support to Calculate Your Loan Costs in Melbourne

Try our online stamp duty calculator as this is a practical first step when you’re considering buying a property. It gives you a clearer picture of the costs and can help you plan with confidence. However, stamp duty rules change over time (and even the name has changed), so it’s wise to get professional guidance.

An experienced Melbourne mortgage broker from Lend & Co will help you find the right loan and confirm the correct stamp duty/land transfer amount you’ll need. Book your free strategy call today and take the next step with confidence.